how to pay indiana state sales tax

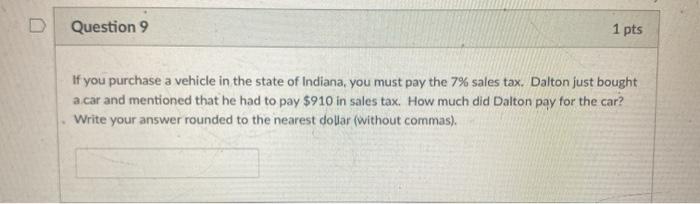

Nexus means that the business has a physical presence in another state. The state charges a 7 sales tax on the total car price at the moment of registration.

For the feds youll need to register with the IRS.

. Indiana businesses have to pay taxes at the state and federal levels. The Indiana sales tax rate is 7 with no local sales taxes. DOR will generate and mail the requested form s to you.

What to Do With the Taxes You Collect. Find Indiana tax forms. The discount varies depending on the size of what was collected.

Then figure the innkeepers tax of 10 percent. The base state sales tax rate in Indiana is 7. Sales Tax Collection Discounts In Indiana.

Know when I will receive my tax refund. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. So collecting sales tax in Indiana is easy just collect the state sales tax rate of 7.

For those collecting less than. Your account number and business. Include your account number tax type start date and end date for the periods needed.

Know when I will receive my tax refund. 100 times 10 equals 10. If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue.

Although trade or dealer discounts are taken off from the sales price any. Add the state sales tax 100 times 07 equals 7. You must send the sales taxes that you charge to the appropriate state which is why it is important to keep detailed records of your.

County Rates Available Online. Exact tax amount may vary for different items. After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales tax on any tangible property sold or shipped from the.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Indiana county resident and nonresident income tax rates are available via Department Notice 1. Indiana businesses only need to pay sales tax on out-of-state sales if they have nexus in other states. But for the Department of Revenue you can do it here.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. For those who meet their sales tax compliance deadlines Indiana will offer a discount as well. All businesses in Indiana must file and pay their sales and.

Indiana allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the. Local tax rates in Indiana range from 700 making the sales tax range in Indiana 700. Find your Indiana combined state and local tax.

2022 Indiana state sales tax. The total cost of the hotel room is 100 plus 7 plus 10 or 117 per.

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

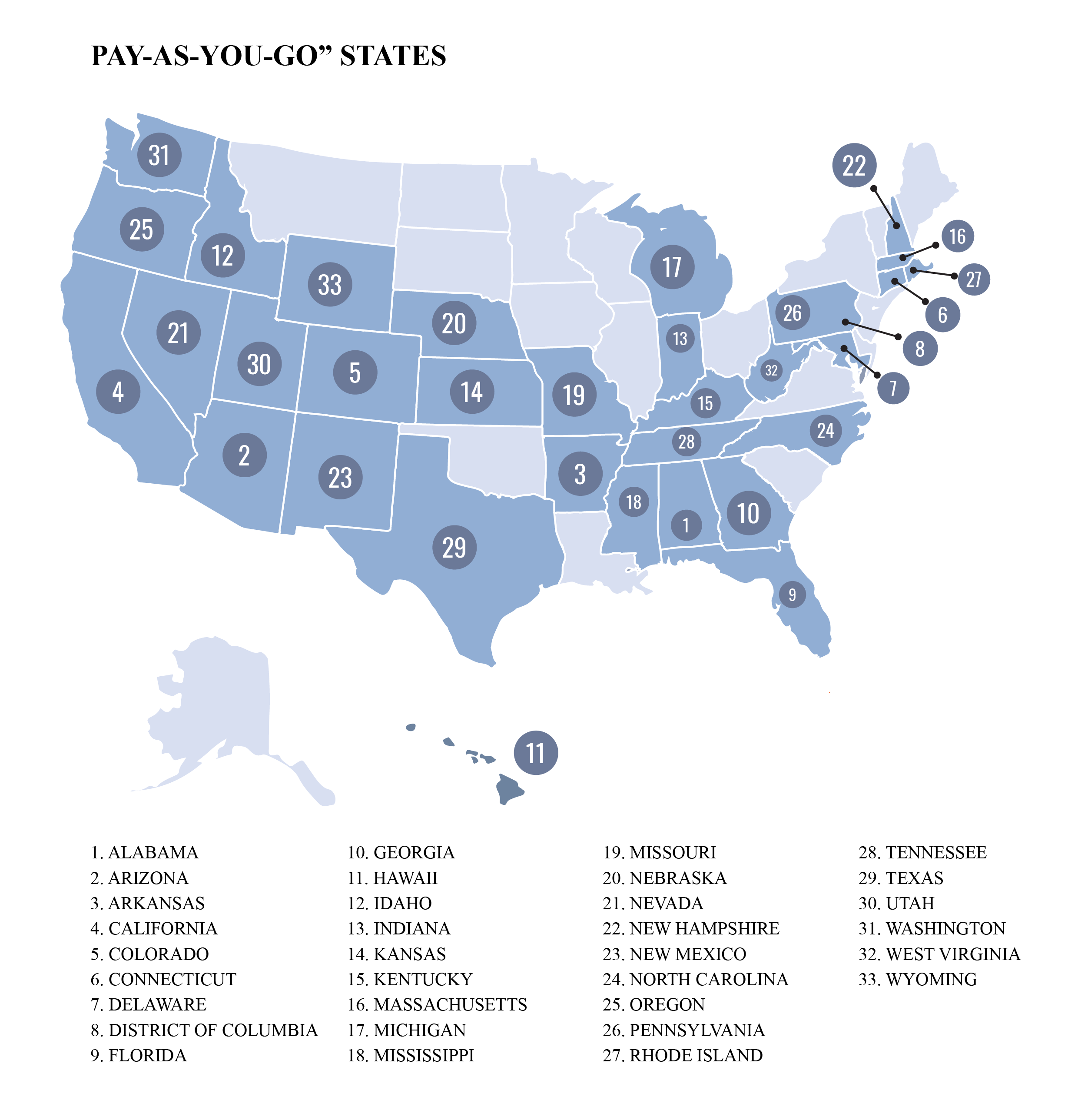

States With Minimal Or No Sales Taxes

Indiana Lawmakers Could Debate Sales Business Tax Changes Indiana Wlfi Com

Sales Tax Indianapolis Business Journal

Are You Cash Negative At The Inception Of A Bhph Deal Due To Sales Tax Lhph Capital

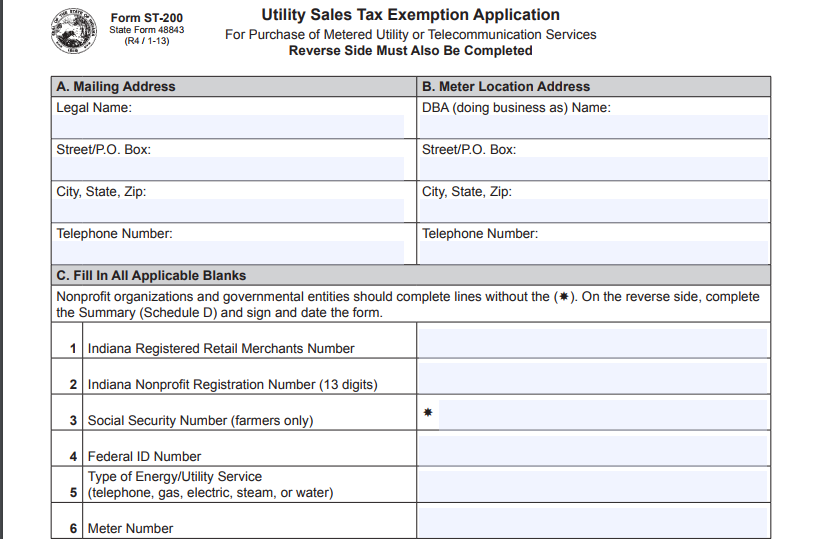

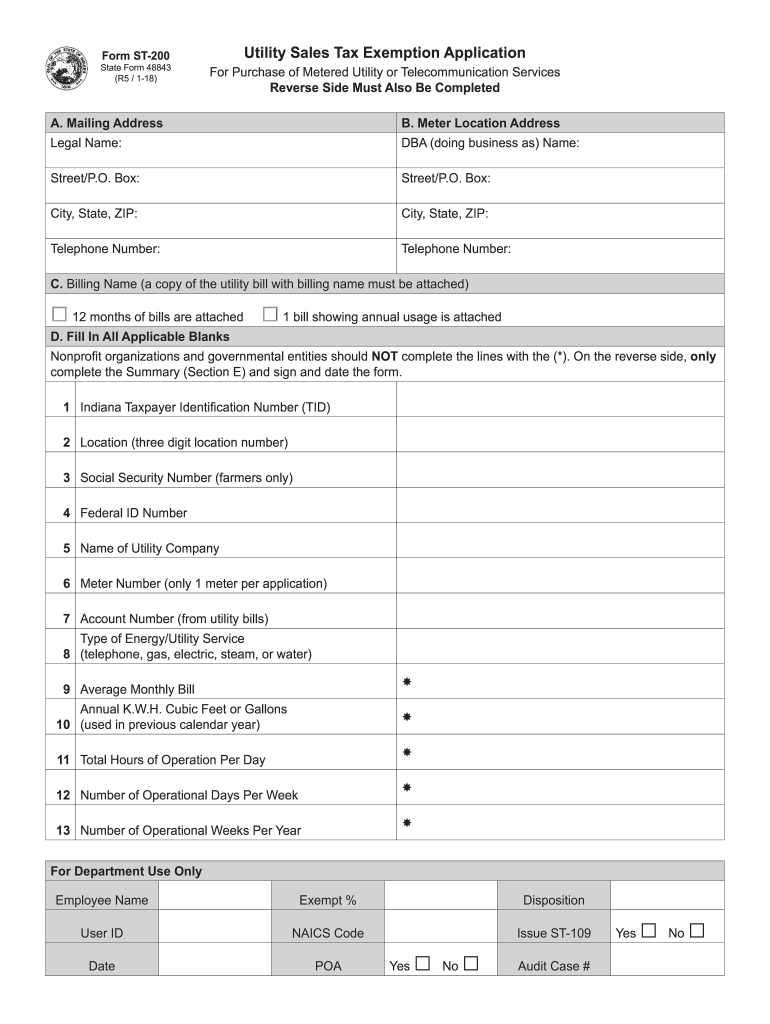

How To File For Utility Sales Tax Exemption In Indiana Blog Enguard Inc

Dealer Digest Summer 2018 Page 2

Indiana Sales Tax Exemption Certificate

Dor Unemployment Compensation State Taxes

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

How To File And Pay Sales Tax In Indiana Taxvalet

Sales Tax By State Is Saas Taxable Taxjar

Car Tax By State Usa Manual Car Sales Tax Calculator

Indiana St 103 Fill Out Sign Online Dochub

Indiana Utility Sales Tax Exemption Application Form St 200 Fill Out Sign Online Dochub

Sales Tax Requirements By State

How To File And Pay Sales Tax In Indiana Taxvalet

Indiana Will Start Online Sales Tax Enforcement Oct 1 Eagle Country 99 3

Solved Question 9 1 Pts If You Purchase A Vehicle In The Chegg Com